Longo Insurance Agency

South Florida Medicare Supplement PlansYou’ve made it. Reaching Senior status these days is not easy. Lets us help you with areas that may be important to you. Let us help you pick the right areas at the best price to reach your goals. Look around and let us know what we can do for you.

Things we can do for you

Medigap Info

OUR SUPPORT IS THE BEST

Medicare Supplement Plans (MEDIgap)

Choose the right plan for your needs.

Latest Medicare Publications

As a token of our appreciation for filling out the contact request form, you will be given an opportunity to view and download the following 4 publications available from the U.S. Government concerning Medicare Insurance and plans, as well as having an Agent contact you with more information.

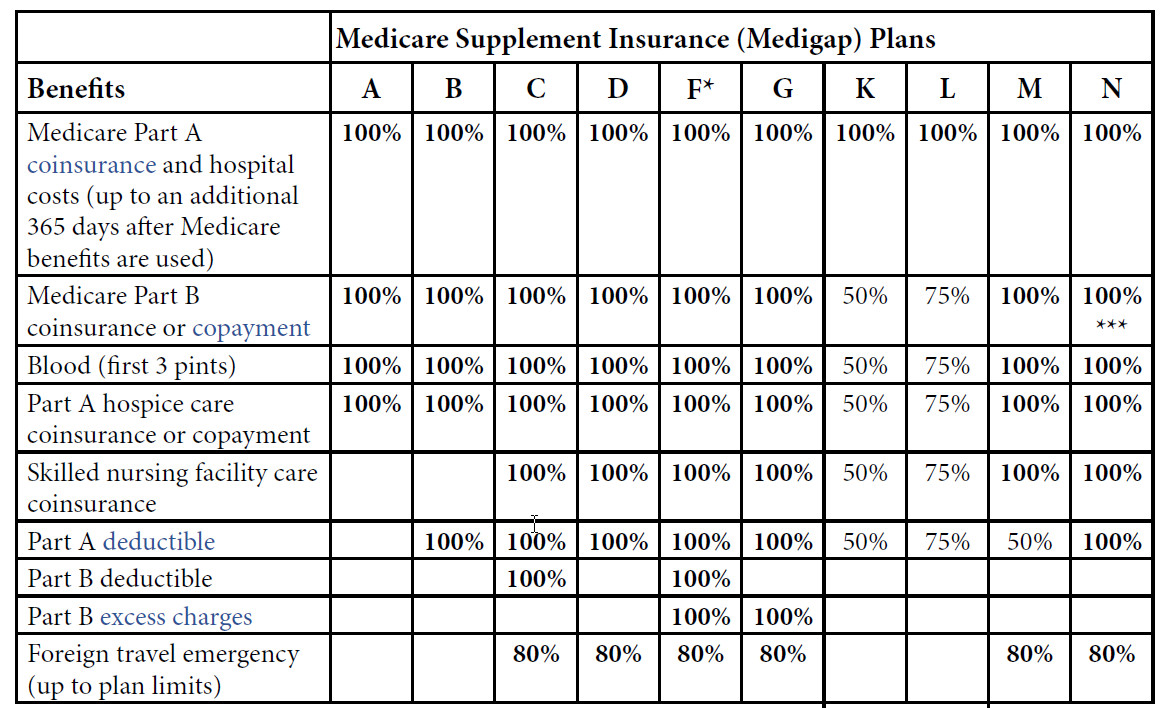

The Plans

Medicare Advantage plans

Choose the right plan for your needs.

Latest Medicare Publications

As a token of our appreciation for filling out the contact request form, you will be given an opportunity to view and download the following 4 publications available from the U.S. Government concerning Medicare Insurance and plans, as well as having an Agent contact you with more information.

What are Medicare Advantage Plans?

Annuities

Choose the right one for your needs.

What are ANNUITIES DIFFERENCES?

About Us

My name is Peter Longo, I have been marketing Medicare Supplement insurance, Long Term Care plans and annuities in Palm Beach, Broward and Dade counties since 1989. I am an independent agent licensed in 1982 and first incorporated in 1989. My 36th year in the insurance business was reached in January of 2018.